If the annual percentage rate may be increased after consummation of. And 3)the amount of credit extended during the term.

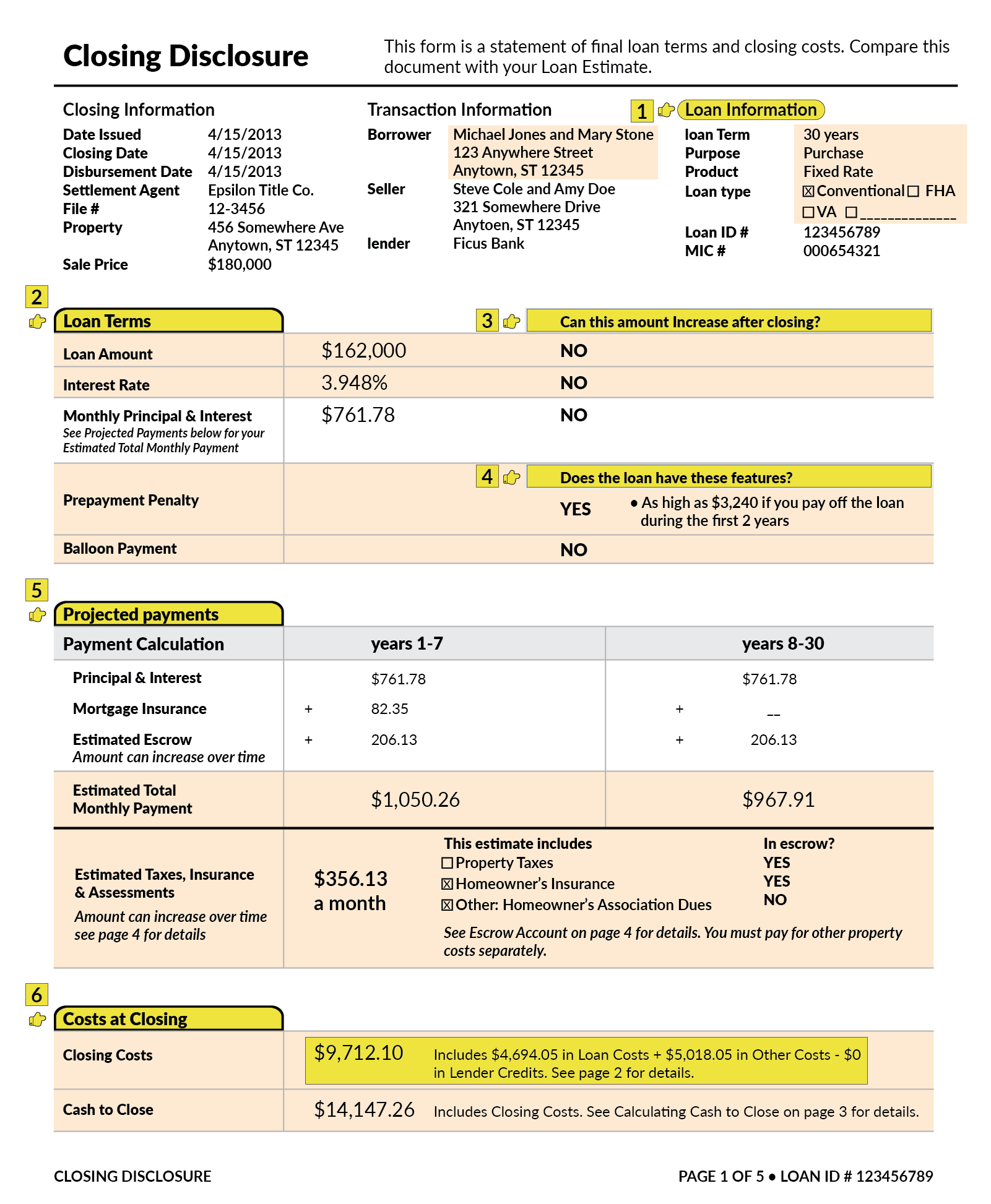

What Is A Closing Disclosure Lendingtree

(d) advertisement of terms that require additional disclosures—(1) triggering terms.

Closed end credit trigger terms. Sometimes mortgage advertisers are not fully aware of the regulation z “triggering terms” rules that require additional disclosures to be made in your mortgage ad. Øminimum, fixed, transaction, activity or similar charge øapr øif plan is variable rate, this fact must be disclosed ødiscounted variable rate ømembership or participation fee (1) the amount or percentage of any downpayment;

The amount or percentage of the down payment; Number of payments or repayment period. Even if the understated apr exceeds the applicable tolerance for regular and irregular loans, the apr will be considered accurate if:

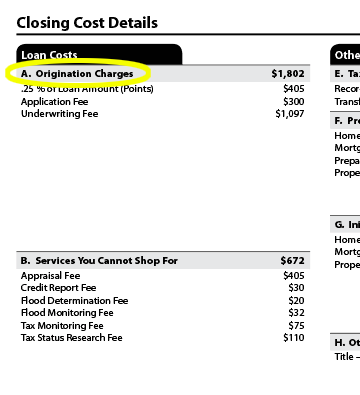

1)the creditor reasonably contemplates repeated transactions; Closed end in the event a financial institution furnishes negative information to a credit bureau for use on a consumer's report, which of the following must it also do? • only $300 origination fee;

These are under section section 226.16 and 226.24. For instance, a few terms for closed end credit that trigger the need for additional disclosure are: • 36 to 72 month auto loans;

Reg z has two marketing sections that address trigger term. Provide the credit bureau with any credit reports received from other bureaus within the last sixty (60) days If any of the following terms is set forth in an advertisement, the advertisement must include the additional disclosures described in d.2.

These provisions apply even if the triggering term is not stated explicitly but. If any of the following terms is set forth in an advertisement, the advertisement shall meet the requirements of paragraph (d)(2) of this section: The annual percentage rate,using that term spelled out in full.

(2) the number of payments or period of repayment; ♦“up to 48 months to pay” ♦“90 percent financing” ♦“as low as $50 a month” ♦“36 equal payments” ♦$500 total cost of credit” of course, there are triggering terms that do not trigger additional disclosure. Or (4) the amount of any finance charge.

Stating “no downpayment” does not trigger. (1) the finance charge is not understated by more than $100 on loans made on or after september 30, 1995, or $200 for. • rv loans up to 108 months;

• 10, 20, or 30 year mortgages; 30 yr mtg loans or 60 low monthly payments *special disclosures. Here’s a quick review of the triggering terms that come straight from reg z 1026.24:

Amount or percentage of any down payment A trigger term is an advertised term that requires additional disclosures. (3) the amount of any payment;

Under § 1026.24(d)(1), whenever certain triggering terms appear in credit advertisements, the additional credit terms enumerated in § 1026.24(d)(2) must also appear. 2)the creditor may impose a finance charge from time to time on an outstanding unpaid balance; Triggering terms that require *s.

(i) the amount or percentage of any downpayment. • “no fees” • “no transaction charges” • not: The periodic rate used to compute the finance charge or the annual percentage rate;

The terms “annual percentage rate” (apr, though the full use of the term must be used once) and “finance charge” when disclosed with a corresponding amount or rate will be more conspicuous than any other disclosure except the credit union’s name.

2

Truth In Lending Act Tila Consumer Rights Protections

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

Federal Register Duties Of Creditors Regarding Risk-based Pricing Rule

Equifax Mistake With My Credit Score Nearly Lost Me A Mortgage Consumer Rights The Guardian

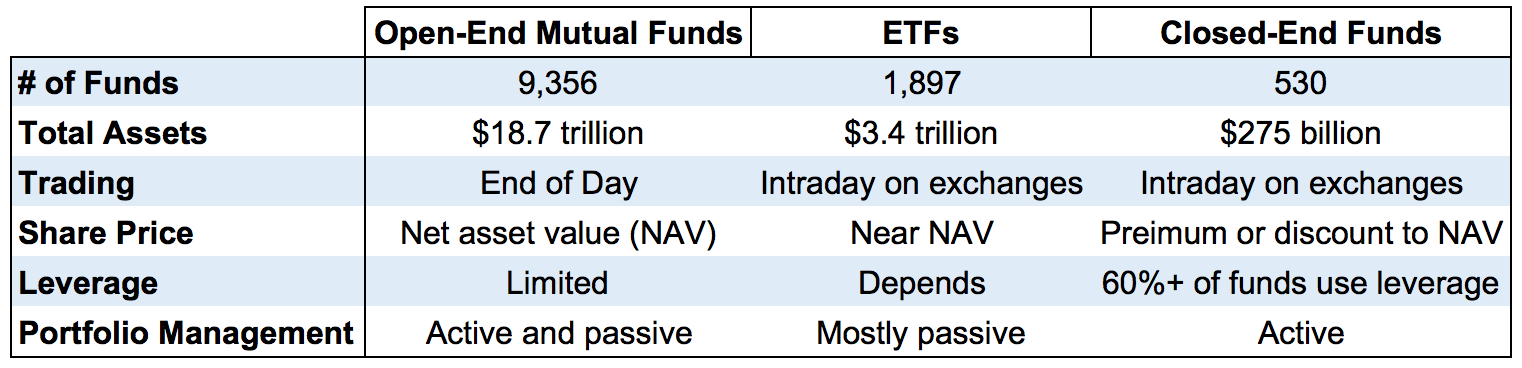

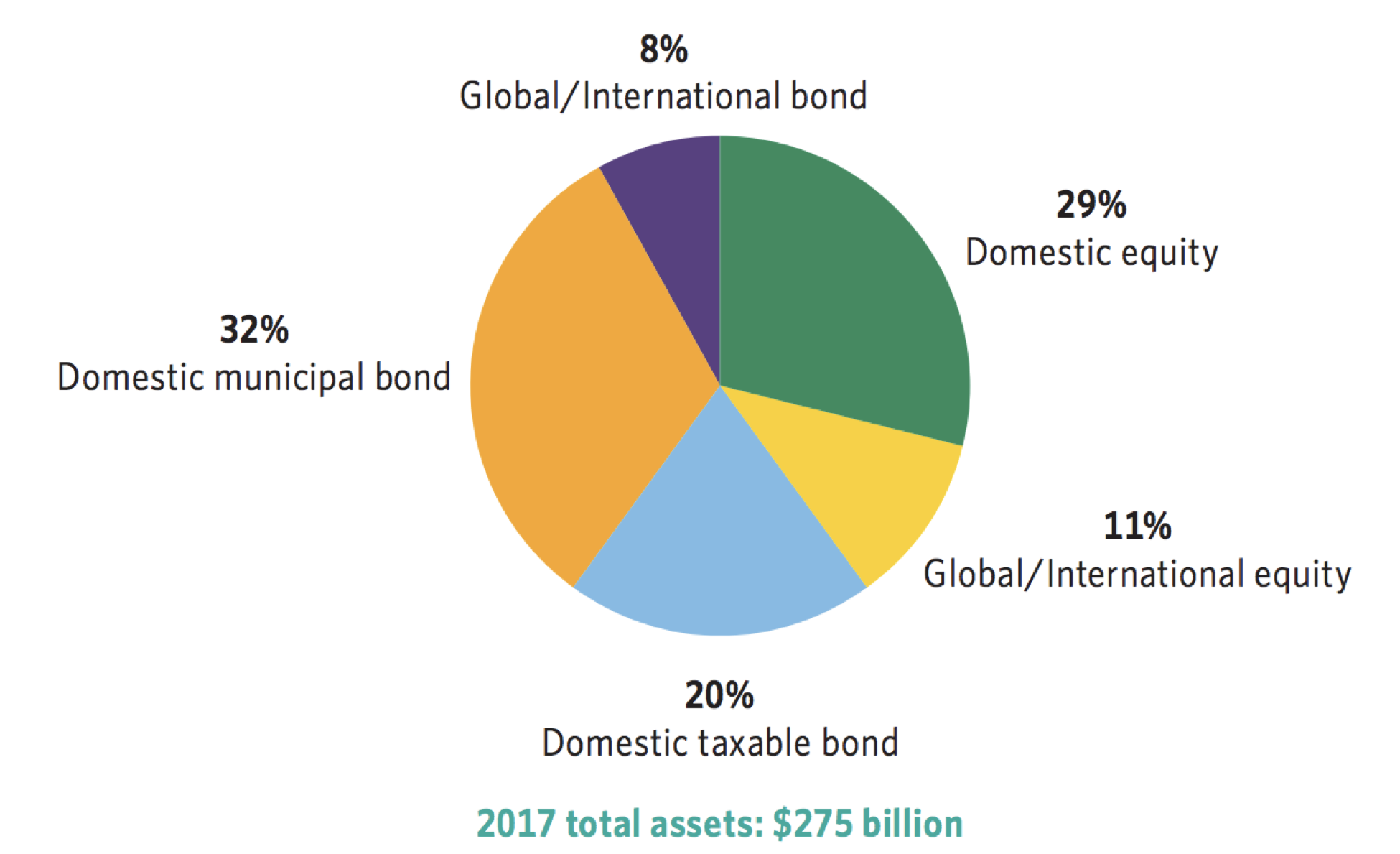

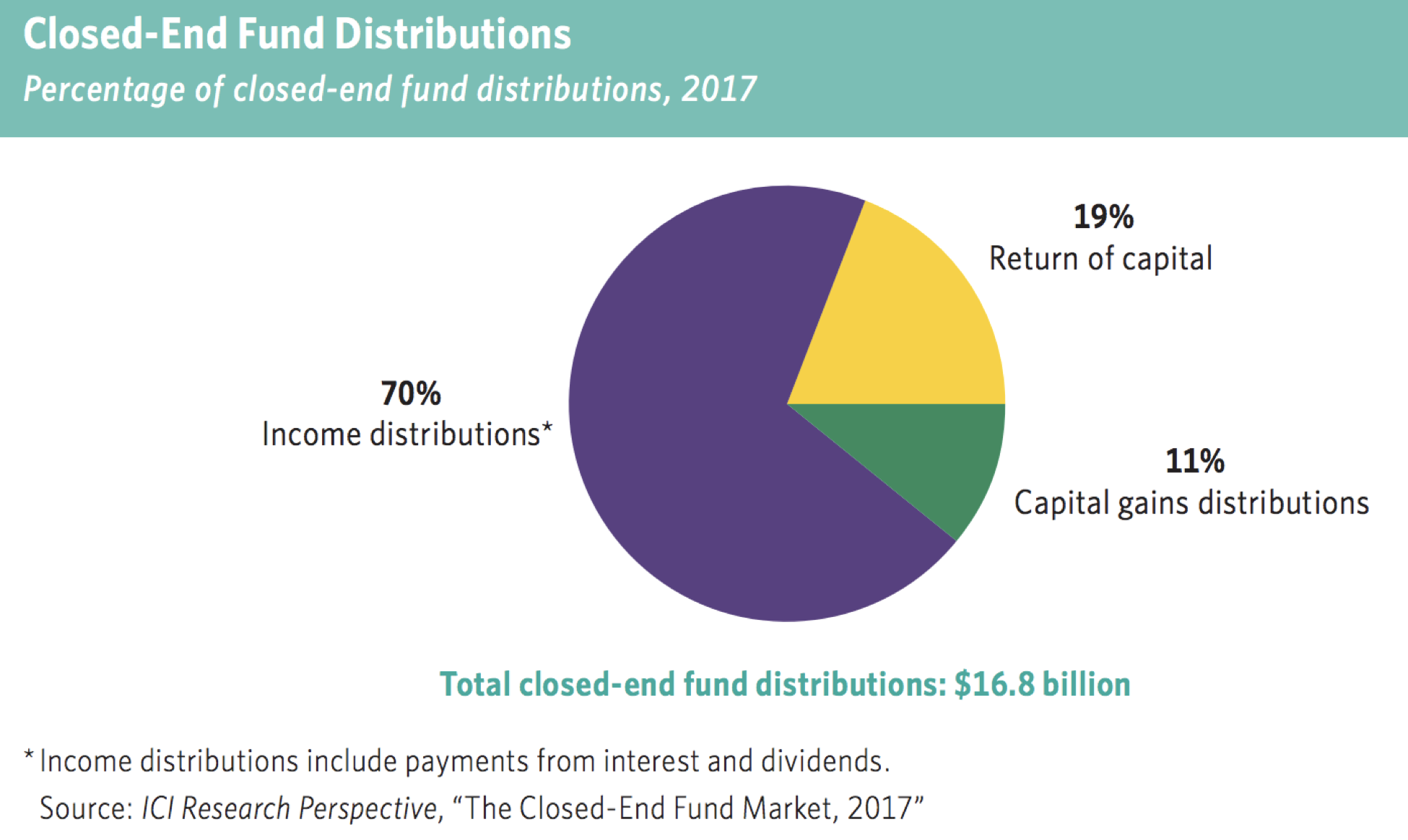

A Guide To Investing In Closed-end Funds Cefs - Intelligent Income By Simply Safe Dividends

Federal Register Duties Of Creditors Regarding Risk-based Pricing Rule

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

What Is A Triggering Term

A Guide To Investing In Closed-end Funds Cefs - Intelligent Income By Simply Safe Dividends

Federal Register Duties Of Creditors Regarding Risk-based Pricing Rule

How Credit Score Agencies Have The Power To Make Or Break Lives Borrowing Debt The Guardian

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)

What Is A Triggering Term

A Guide To Investing In Closed-end Funds Cefs - Intelligent Income By Simply Safe Dividends

Federal Register Duties Of Creditors Regarding Risk-based Pricing Rule

Closing Credit Cards How To Credit Score Impact

2

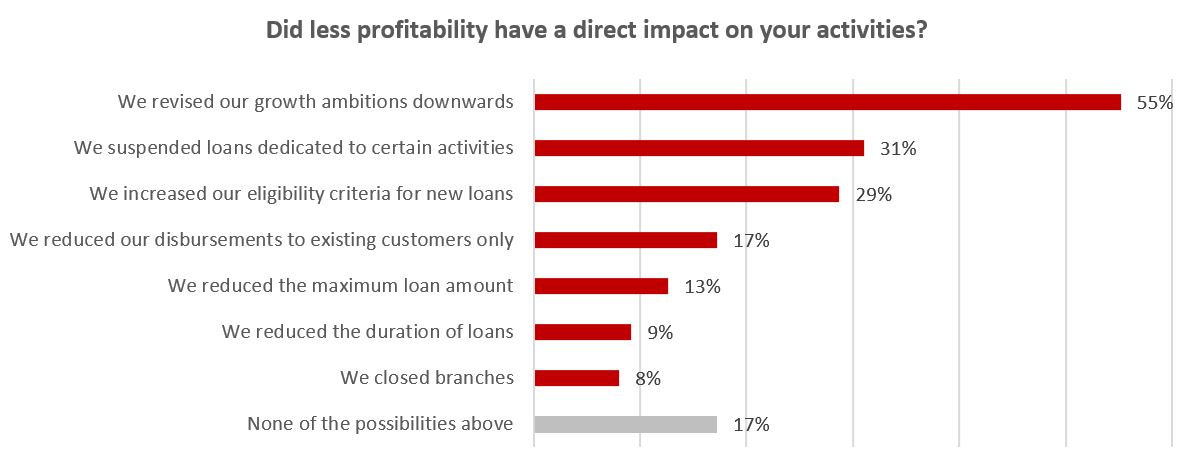

Media Room Fondation Grameen Credit-agricole

Understanding Finance Charges For Closed-end Credit

Federal Register Duties Of Creditors Regarding Risk-based Pricing Rule