A list of different annual percentage rates applicable to different balances, for example, does not trigger further disclosures under § 1026.24 (d) (2) and so is. Triggering terms that require *s.

Pdf Using Genetic Algorithms For Credit Scoring System Maintenance Functions

(d) advertisement of terms that require additional disclosures—(1) triggering terms.

Closed end loan trigger terms. (4) the amount of any finance charge. In a form the member may keep. The disclosures will be in a reasonably understandable form and legible.

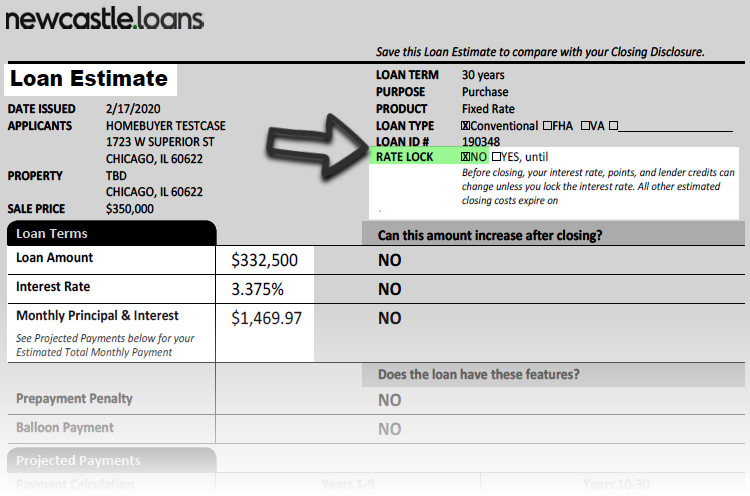

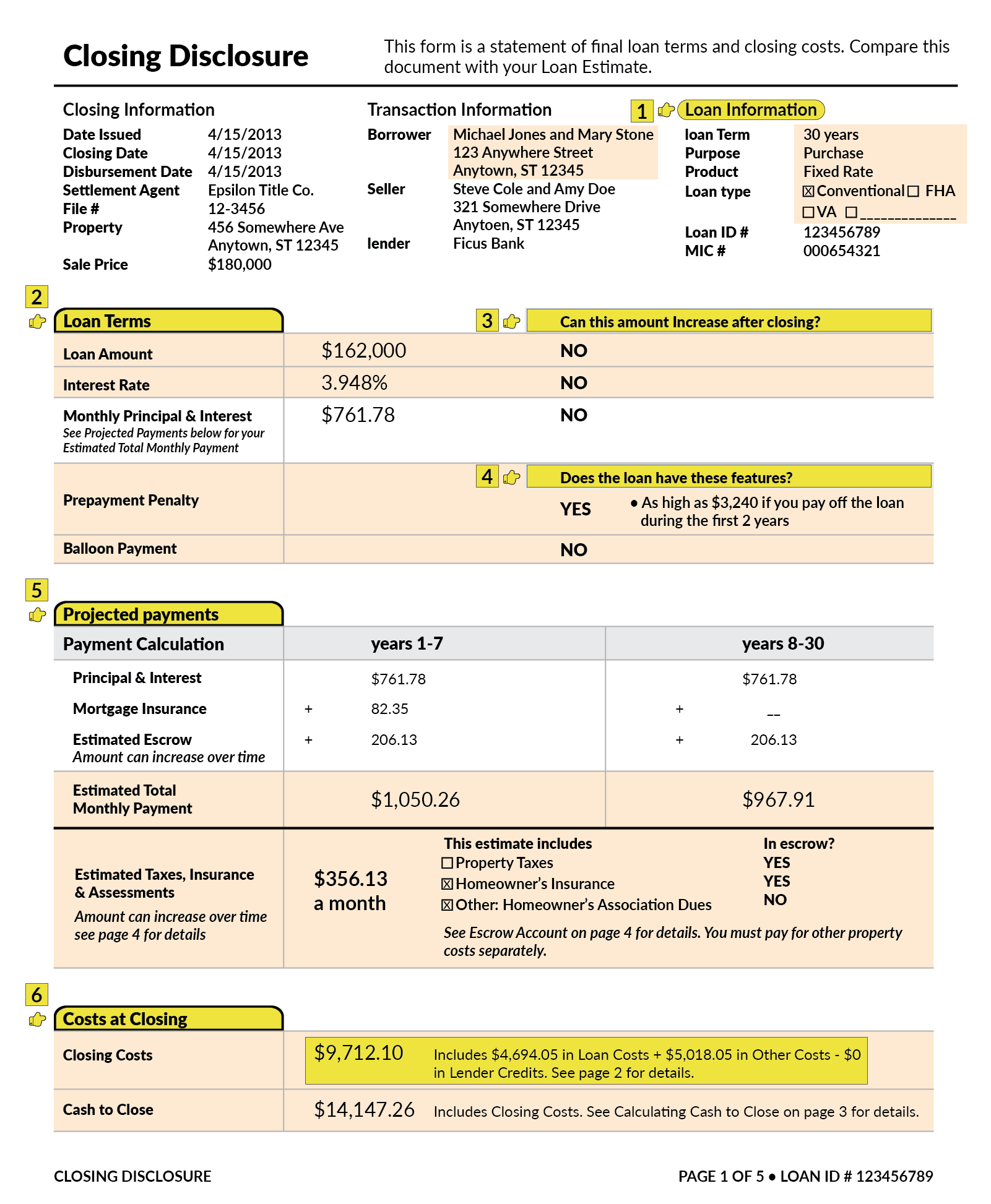

If any of the following terms is set forth in an advertisement, the advertisement must include the additional disclosures described in d.2. The loan estimate is provided within three business days from application, and the closing disclosure is provided to consumers three business days before loan consummation. • 36 to 72 month auto loans;

• 10, 20, or 30 year mortgages; The disclosures will be in a form that the Clearly and conspicuously in writing.

Sometimes mortgage advertisers are not fully aware of the regulation z “triggering terms” rules that require additional disclosures to be made in your mortgage ad. The rule applies only if the advertisement contains one or more of the triggering terms from § 1026.24 (d) (1). (3) the amount of any payment;

♦“up to 48 months to pay” ♦“90 percent financing” ♦“as low as $50 a month” ♦“36 equal payments” ♦$500 total. (1) the amount or percentage of any downpayment; These disclosures must be used for mortgage loans for which the creditor or mortgage broker receives an application on or after august 1, 2015.

Stating “no downpayment” does not trigger additional disclosures. (2) the number of payments or period of repayment; Engaging in fraud or deception to conceal the true nature of the mortgage loan obligation, or ancillary products, from an unsuspecting or unsophisticated borrower b.

Here’s a quick review of the triggering terms that come straight from reg z 1026.24: Making loans based predominantly on the foreclosure or liquidation value of a borrower's collateral rather than on the borrower's ability to repay the mortgage according to its terms Amount or percentage of any down payment

Øminimum, fixed, transaction, activity or similar charge øapr øif plan is variable rate, this fact must be disclosed ødiscounted variable rate ømembership or participation fee The periodic rate used to compute the finance charge or the annual percentage rate; Number of payments or repayment period.

30 yr mtg loans or 60 low monthly payments *special disclosures. • “no fees” • “no transaction charges” • not: There are triggering terms associated with different loan products, such as home equity credit lines, closed end credit, helocs, and many other loan products.

For instance, a few terms for closed end credit that trigger the need for additional disclosure are: The amount of the down payment, expressed either as a percentage or as a dollar amount. • rv loans up to 108 months;

2

Residential Mortgage Loans And Fund Sources - Ppt Download

2

Understanding Finance Charges For Closed-end Credit

How To Lock-in A Low Mortgage Rate

2

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

What Is A Triggering Term

Federal Register Facilitating The Libor Transition Regulation Z

2

Bermuda In Imf Staff Country Reports Volume 2005 Issue 099 2005

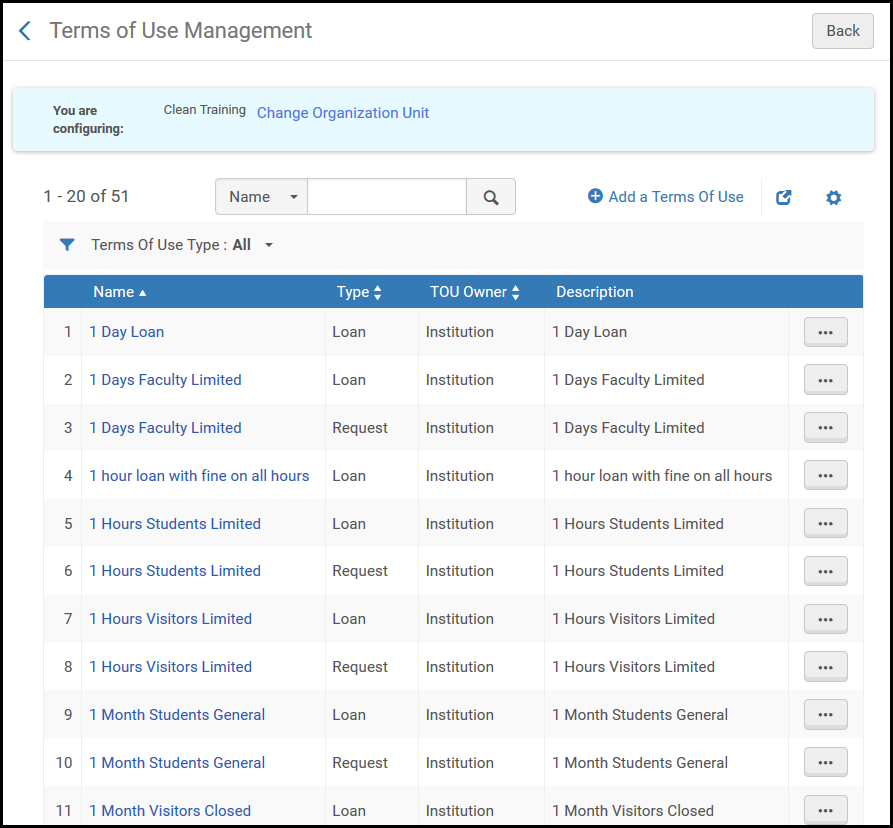

Physical Fulfillment - Ex Libris Knowledge Center

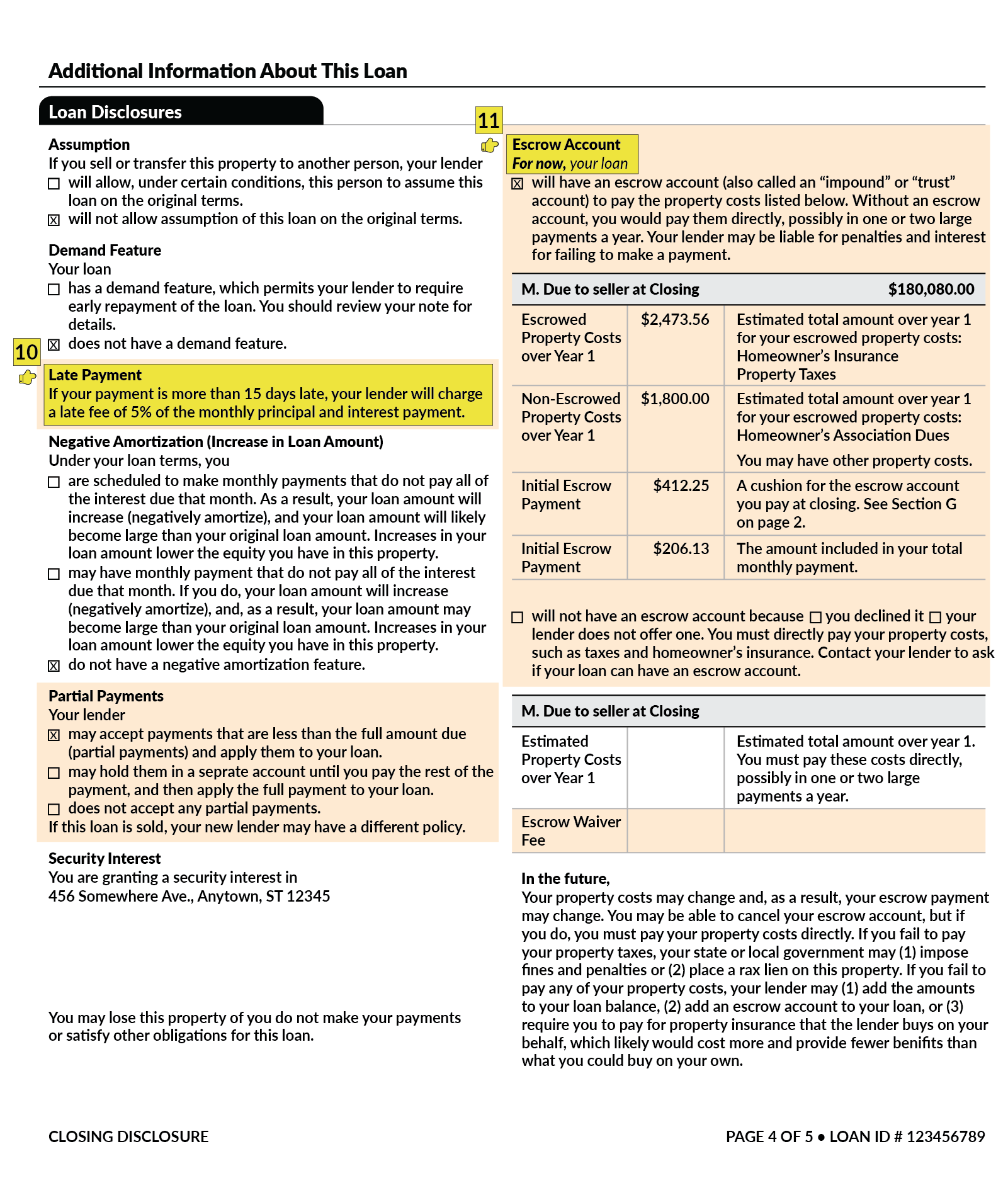

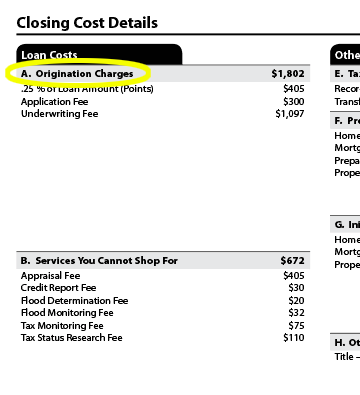

What Is A Closing Disclosure Lendingtree

2

2

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)

What Is A Triggering Term

What Is A Closing Disclosure Lendingtree

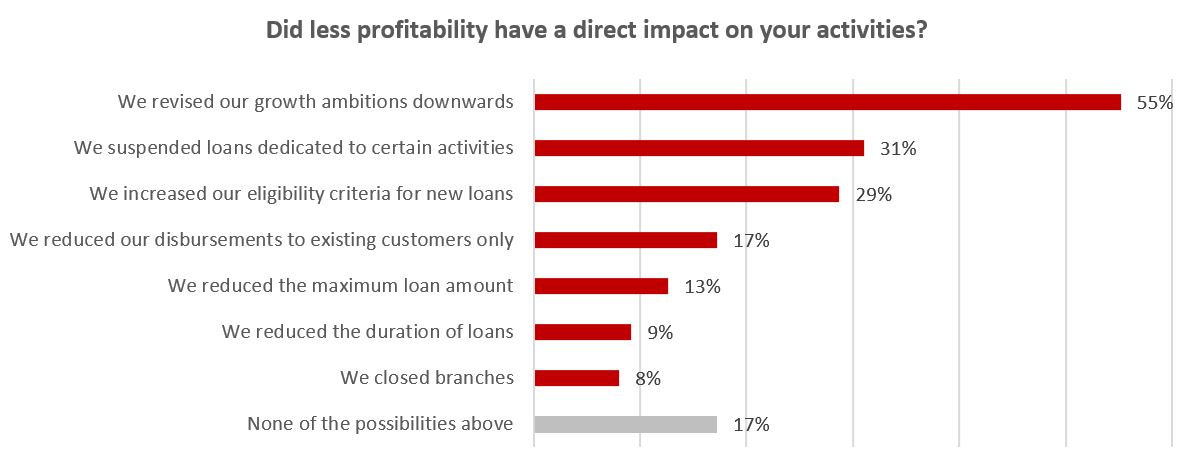

Media Room Fondation Grameen Credit-agricole

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

2